Global stocks sank Wednesday after US President Donald Trump said he was not satisfied with talks that are aimed at averting a trade war with China. Equities were also dented by poor eurozone economic data, and as Trump cast doubt on a planned summit with North Korean leader Kim Jong Un. “Trump (is) continuing to drive uncertainty over global trade,” said analyst Joshua Mahony at trading firm IG. “European markets are following their Asian counterparts lower, as a pessimistic tone from Trump is compounded by downbeat economic data,” he added. Markets had surged Monday after US Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He said they had agreed to pull back from imposing threatened tariffs on billions of dollars of goods, and continue talks on a variety of trade issues. However, Trump has declared that he was “not satisfied” with the status of the talks, fuelling worries that the world’s top two economies could still slug out an economically pain...

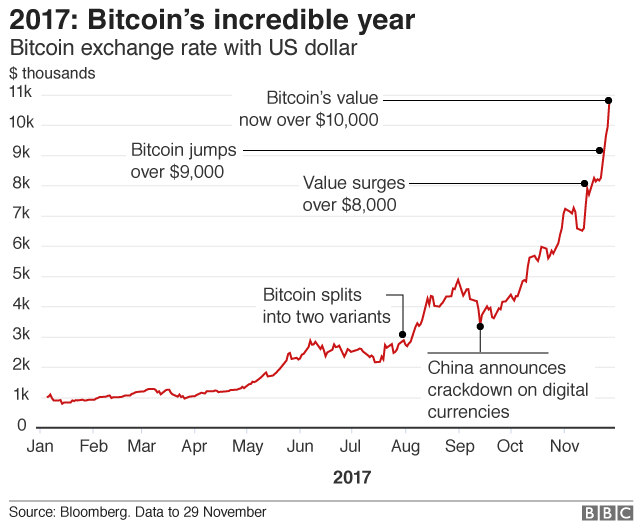

The value of one bitcoin has gone past $10,000 (£7,493).

The virtual currency reached the benchmark for the first time, just days after it passed $9,000.

It caps a remarkable rise in value for the crypto-currency, which was trading below $1,000 at the start of the year.

Some experts believe the asset still has far to soar, but others say it represents a speculative bubble with nothing tangible at its core that could burst any time.

The total value of all the bitcoins in existence has now surpassed $167bn.

Bitcoin first reached $1,000 in late-2013 and then dipped significantly before starting a volatile climb to its current value.

It is not entirely clear what has driven the sudden rise in value, especially because the past few weeks have been marked by action by some financial regulators to limit its use.

New heights

One factor that may have helped was the US-based derivatives marketplace operator CME Group's announcement at the start of the month that it planned to launch a Bitcoin futures product before the end of 2017, which bolstered confidence in its prospects.

Another was a decision to drop a controversial plan known as Segwit2x.

This would have altered the way Bitcoin's underlying technology, the blockchain, worked, to help it handle more transactions.

But the move risked splitting the community.

Many industry watchers believe the rapid rise in value will not be sustained and expect its value to suddenly fall sharply.

Bitcoins were first produced in 2009 and took a long time to become an accepted holder of monetary value that could be swapped for real-world cash.

One early transaction involved using 10,000 bitcoins to buy two pizzas.

The boom has led to a general rise in many other virtual currencies.

One, known as Ethereum, is now worth about $480, but at the start of 2017 each one was worth only about $10.

Many others are also trying to profit from the growing interest in crypto-currencies.

Many malware writers are now seeking to install software on vulnerable websites that create or "mine" the coins.

In addition, scammers have sent fake text messages to people's phones, claiming they own some of the digital currency, in an effort to tempt them into opening a dangerous link.

Comments

Post a Comment